Understanding interest rates and charges

Credit cards can be a secure and flexible way to pay for things, much like a debit card. You can use them to pay for purchases online, over the phone and when you're in a store. They can also be a convenient way to borrow money (up to your credit limit) when you do not have your own funds available right away, allowing you to pay back the balance at a time when you can afford it (minimum monthly repayments do apply though).

Along with the features and benefits of a credit card, you should also understand what the interest rates, fees and charges that apply to using one.

Interest is a charged for borrowing money from a bank or financial institution when you use your credit card. It is applied when you have an outstanding balance and are not within the interest-free period. Credit card interest is calculated daily on any outstanding balance and is charged at the end of the statement period if you haven't paid the outstanding balance off. How much interest you pay depends on which type of credit card you have, what type of transaction you make (i.e. find out more about cash advances below) and when you make your repayments.

Credit card Interest rates

Standard purchase rate: this relates to the things you buy on your credit card (eg. groceries, petrol, subscriptions, online shopping etc) it is generally the most referenced interest rate on your card and is referred to as the annual percentage rate (APR). For example the APR on purchases for an ING Orange One Low Rate credit card is 12.99% p.a. variable.

Cash advances: A cash advance interest rate is the rate charged when you withdraw cash like you would from a debit or savings account. Cash advance transactions, such as ATM withdrawals or cash-out at shops often attract interest rates that are higher than the standard purchase rate and they usually attract interest from the moment they're made. The ING Orange One Low Rate credit card does not have a higher interest rate for cash advances, but fees will apply and no interest fee period is offered.

Instalment plans: Credit cards with an instalment plan feature allow you to 'lock in' a lower interest rate than the standard purchase rate. With the ING Orange One Credit card If you have a balance of $250 or more, and you're not going to pay it off in one hit, you can move this amount to an instalment plan (at a lower interest rate than the APR!), and pay it off in fixed monthly instalments.

Limitations and exclusions apply to the establishment of instalment plans.

Compare credit card rates across the range on ING credit cards. Find the best credit card purchase rates to suit you and your lifestyle.

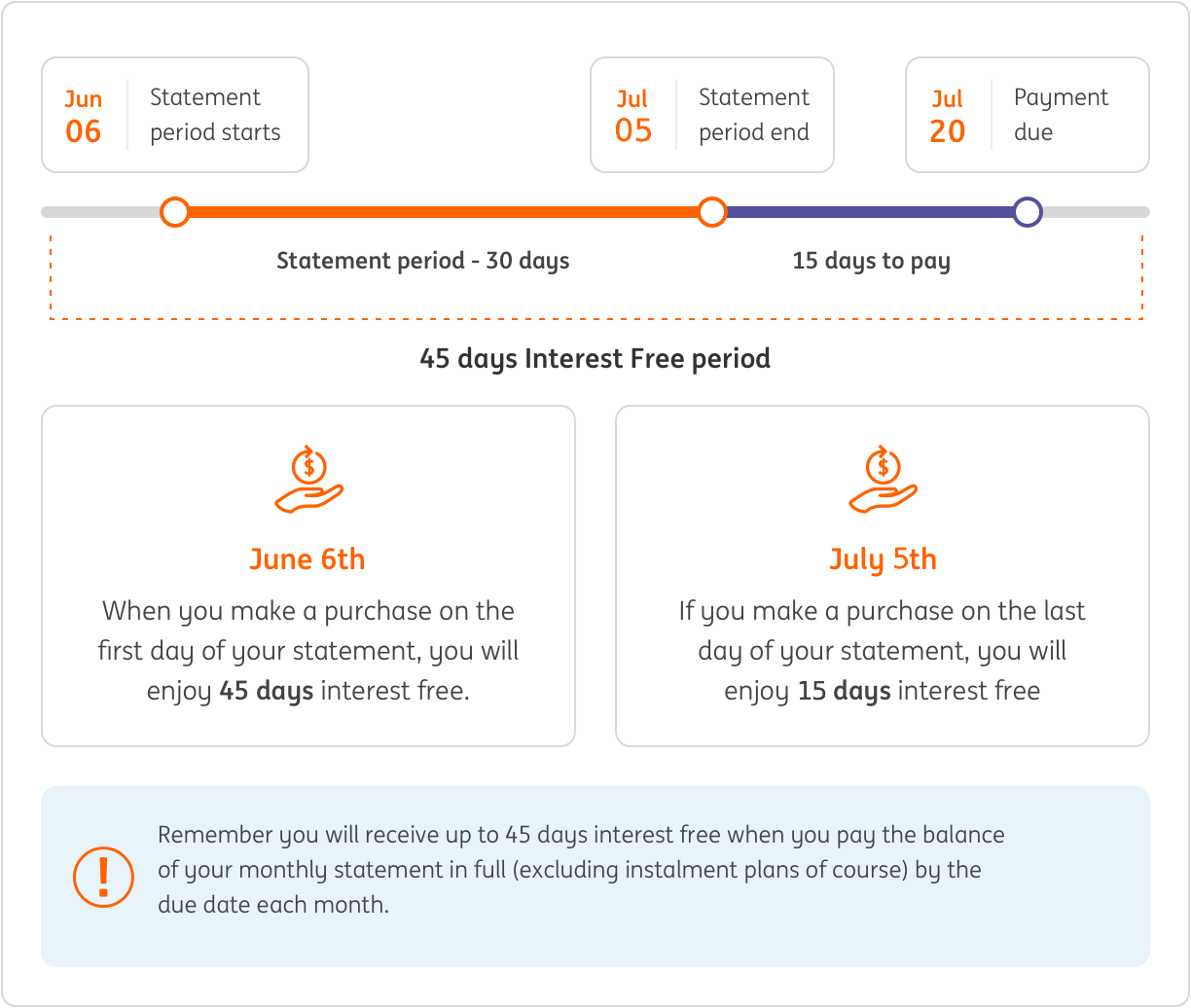

Interest free days

Interest-free days on credit cards are a set number of days in which you won't be charged any interest on purchases, provided that you pay off your monthly balance in full. Most credit cards come with an interest free period on standard purchases. ING has up to 45 days interest-free on the Orange One credit cards. Note that to get the benefit of an interest free period, you need to have paid your previous month's closing balance in full and have no outstanding debt (excluding an instalment plan of course) on that card. Let's have a closer look at an example of how the interest free benefit may work.

Credit card fees

Some credit cards come with an annual fee which varies between banks and the type of credit card. The credit card annual fee is deducted from your available credit and accrues interest at the purchase rate unless an interest free period applies or you pay it off to $0.

During the life of your credit card you may be charged other fees. Some include late payment fees, over limit fees, international transaction fees and cash advance fees.

With an ING Orange One credit card we try to keep the fees as low as possible but fees still do apply. See our rates and fee schedule to see all the fees that apply.